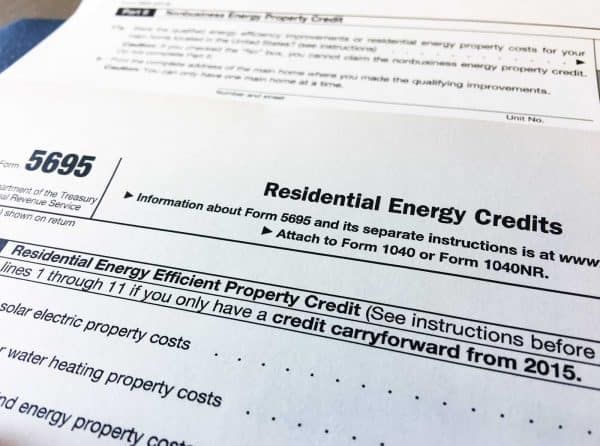

2024 1040 Schedule 5695 Instructions – To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A to document your costs on IRS Form 5695. You can also deduct interest from . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

2024 1040 Schedule 5695 Instructions

Source : www.irs.govSchedule 3: Fill out & sign online | DocHub

Source : www.dochub.comIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comHow To Fill Out IRS Form 5695 to Claim the Solar Tax Credit

Source : palmetto.comHow to Claim the Solar Tax Credit in 2024 | Arizona

Source : southfacesolar.comIRS Releases Form 5695 Instructions and Printable Forms for 2023

Source : www.wicz.com1040 (2023) | Internal Revenue Service

Source : www.irs.govGet ready to file in 2024: What’s new and what to consider

Source : www.wlbt.com2024 1040 Schedule 5695 Instructions 2023 Instructions for Form 5695: When you decide to close your sole proprietorship, there are no special instructions to follow, except what is normally required for sole proprietorships. Complete IRS 1040 Schedule C . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

]]>